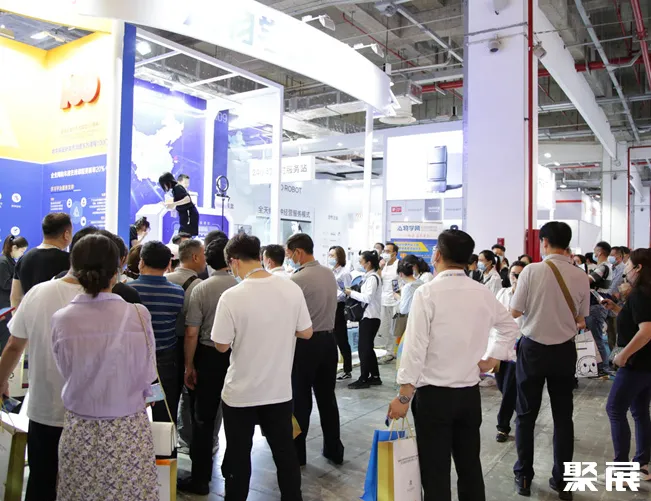

2025.10.22-10.23,备受瞩目的深圳国际物业管理产业展览会将在深圳福田会展中心隆重举办,预计将吸引超过30000名来自不同渠道的专业观众,展商数量预计将超过400家,展出面积达到26000㎡平方米,为地产企业提供了一个开放和高效的交流平台。

深圳市地产展展商名录

如果您需要获取展商名录,可以通过官方网站或者相关的展会服务网站(聚展网)进行预订。展商名录通常包含展商的联系信息、产品介绍等,对于希望建立商业联系的观众来说非常有用。请注意,展会的具体安排和参展商名单可能会有变动,建议关注官方发布的最新消息以获取准确的信息。深圳国际物业管理产业展览会

展览时间:2025.10.22-10.23 举办展馆:深圳福田会展中心 举办地址:深圳市福田区福华三路 展览规模:展览面积26000㎡平米、观众人数30000名、参展商400家 主办单位:SPME组委会

深圳市地产展展品范围:

智慧社区O2O、智慧停车系统及设备

智能安防、智能家居、自助服务设施

物业制服、环境绿化维护、楼宇智能化

社区与商业场所娱乐设施、节能解决方案

科技物业、物业相关配套服务(本文内容版权归属聚展所有,未经同意,禁止转发)

参考资料:

SPME- 举办地址:

- 深圳市福田区福华三路

- 展览面积:

- 26000㎡

- 观众数量:

- 30000人